This post was most recently updated on May 31st, 2024

Google Ad Manager now offers Optimized Pricing by default which is meant to help publishers protect and increase the long-term value of a publisher’s ad inventory. But, why did they come up with this innovative feature now, and how does it stack up against bid shading? Keep reading to find out.

Google has added its latest Optimized Pricing feature to its ad inventory pricing model, Unified Pricing Rules (UPR) so that publishers can benefit from it. Let’s break down what UPR actually is? Google Ad Manager’s Unified Pricing Rules will allow publishers to configure and unify the price floors for all programmatic demand types. Publishers can protect the value of their inventory using Optimized Pricing in addition to Unified Pricing Rules. You’ll never have to worry about advertisers buying your inventory for less than what it’s worth. In instances where the floor prices are set too low, Google’s algorithm automatically raises them with Optimized Pricing.

This warns the buyers informing them to stop shading their bids below a specific floor price threshold. Basically, Google is aiding publishers to markup their clearing prices by favoring them over DSPs bid-shading algorithms.

However, on its buy-side platforms, Google also enables media buyers to optimize their bid prices aka media costs with its bid-shading feature. So, do publishers win with Google’s Optimized Pricing feature or is it the advertisers that profit from the bid-shading algorithm? Google offers great features for publishers and buyers, but how will it determine the value of inventory? Let’s dig deeper.

The Optimized Pricing feature innovatively increases the auction floor prices via machine learning to protect the value of publisher’s ad inventory from going down. Floor price optimization is able to accurately reflect your inventory’s value, meaning buyers cant purchase it for less than its actual value.

The Optimized Pricing feature scans for queries where the floor price looks low or doesn’t reflect the actual value bidders may plan to place on your ad inventory. When it does, it automatically increases the floor for all bidders, and applies that floor to the auction, preserving the long-term value of that inventory. Through this AI-driven mechanism, Optimized Pricing raises the price paid for your ad inventory aka CPMs while maintaining your overall yield.

GAM will enable this feature by default. However, if you want to opt out of inventory value protection, you can disable Google’s optimized pricing by:

Things to consider:

In Google Ad Manager, Dynamic Allocation involves including the highest competing remnant CPM signals (from Prebid wins, third-party advertising networks, and bulk line items) in its bid requests to Google Ad Exchange, then seeking a higher price from the Authorized Buyers. Currently, only the highest applicable UPR floor or temporary CPMs are included in bid requests.

The result is that Google Ad Exchange and Open Bidding buyers can only rely on the publisher floors (usually set too low) to make bidding decisions without having any clue of the real-time dynamics of competition across all demand channels. In the absence of the last look advantage, Google’s bid prices have often seemed less competitive and shaded too much.

Publishers benefit from Optimized Pricing by increasing the floor price and securing their ad inventory’s fair value. Media buyers behind open bidding and ad exchange are also better informed of the competition & can offer higher bids that compete for impressions with other DSPs. Only Open Bidding and Google AdX buyers are directly informed about optimized pricing here. UPR signals are not propagated to Prebid bidders with prebid auctions currently happening before & outside Google Ad Manager.

Since the pricing is optimized automatically, it only increases floor prices; it does not decrease them if these are too high. Publishers need to maintain their UPR structure always and trust Google’s Optimized Pricing to do its job.

Since Optimized Pricing is a network-level optimization feature and it can’t be split tested yet, the performance can only be checked before and after the price changes. Along with floor prices, you need to also look into overall revenue impact. There is no control over how much higher Optimized Pricing raises the floor on top of the existing UPRs, which could impact third-party programmatic revenue or lead to impressions not getting sold.

You can check out Google’s guide on optimizing floor prices in UPR here. By using Google’s machine learning algorithms, publishers are able to set floors prices dynamically per bid request.

While this is a beta feature that can be split tested, once activated, Google’s proposed floors will supersede any overlapping publisher’s UPRs apart from buyer-friendly floors.

In the coming months, publishers can finally come to a conclusion on whether Google’s optimized pricing will increase their overall ad revenue as well.

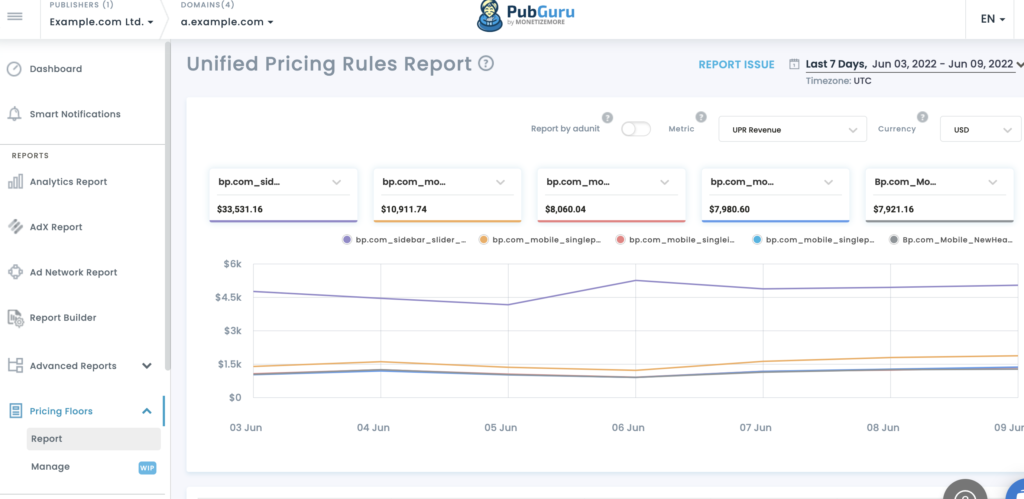

MonetizeMore’s very own UPR feature, not only measures the performance of the UPRs, but it helps publishers create and customize their pricing experiments. In doing so, publishers can get rid of their intricate manual process and streamline it with PubGuru.

Learn more about how you can set your own floor prices with UPRs here

With over ten years at the forefront of programmatic advertising, Aleesha Jacob is a renowned Ad-Tech expert, blending innovative strategies with cutting-edge technology. Her insights have reshaped programmatic advertising, leading to groundbreaking campaigns and 10X ROI increases for publishers and global brands. She believes in setting new standards in dynamic ad targeting and optimization.

10X your ad revenue with our award-winning solutions.